Sagisu Friday Beats - What did you get done this week?

Commerce, Shipping & Finance

We are creating this newsletter to be interested in everything that is going on in and around us at a broad and bare minimum with some content that will ensure we invoke curiosity and interest. We are hyper curious and want to be extra-ordinary/the best at our work and insights. This newsletter is a first step towards that future. We will try to be independent thinkers, random, thoughtful and authentic as best as a potential hyper realist.

We will talk a lot about Commerce, Commodities & Shipping, Finance & Crypto as we are very interested in learning and interpreting what sells, what ships and what finances the world transactions. Once our research becomes extensive, we will break the newsletters into each specific areas of focus.

We know that we will be wrong a lot and we love our failures and will always learn from our failures. We also believe winning is a habit.

Around us:

FTX - One name that haunts the new wild west industry today is Sam Bankman-Fried and his group of companies. A speed train that got Rekt (Wrecked) fast. Success is never last and Failure is never final. Failure is an orphan. We will write a longer post on our thinking and collate our data points over the next week.

FOMC raised interest rates again last week. Cost of capital will go up and “will inflation break?” is something we need to wait and watch. Food for thought: Consumer spending in the US at the ground level is off the charts. Every store is crowded, every restaurant is house-full, labor is short in most categories and Uber always has a wait time once you request for a ride.

A modest expectation would be that profits will dwindle down and the companies that don’t make any profits should start planning their runway over the next few years

Elon Musk completed an acquisition of Twitter and the machinery engine is being worked as the driver of the vehicle changed. Food for thought: Why did Elon Musk buy Twitter? Does he truly believe in free speech? Will it become the open townsquare? Will the bots, narratives, left and the right wings, advertisers and the newly verified community of people work well. Can scammers be verified too at $8 a month? How do you know he/she is not a scammer or a bot?

Eli Lilly and Company had to fight with multiple Verified fake accounts.

180 fighter jets this morning were seen flying in the Korean peninsula.

All over this week we have seen the grain deal go back and forth and it feels we have the grain deal back on.

Are we approaching Stage 6 as Ray Dalio mentions in his write-up last week that makes an important & interesting read and how you and I can look into the future to prepare ourselves.

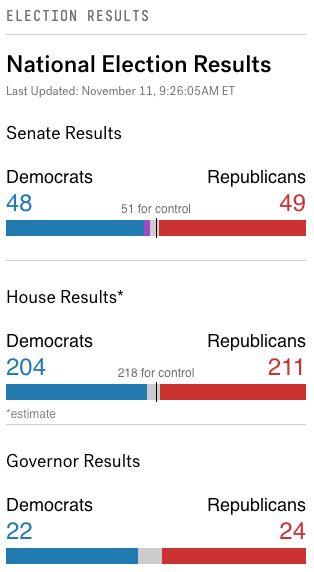

US Elections always influence beyond borders. Midterms were nothing like anyone expected. The voters appear to be more in the center than left or right. What was supposed to be done and dusted is still open with a run-off. We still have not seen the sweeping red.

Interesting Info:

Sleeping in space is not as normal as we believe it would be as in our homes. Sleeping in space is an important part of a mission, with impacts on the health, capabilities & morale of astronauts and it's not easy. Even the posture, due to micro gravity, ends up by looking totally unnatural as shown in this Shuttle footage. This was recorded of NASA select TV in the 2000s. Astronauts sleeping on the Space Shuttle is kind of funny to watch. Some like their arms to float free, others like them constrained.

Now let us think about a future where we are interplanetary and Space X achieves its mission to transport 100s of people to Mars. Let us leave it at it is going to be much better than this.

Future is not bleak but always bright.

“Everyday is a second chance to do everything you have wanted to do…..”

Special Day of this week:

ON THIS DAY: At the 11th hour on the 11th day of the 11th month of 1918, World War I ended as the armistice was signed in a railway carriage in Compiegne, France, bringing to a close a conflict in which more than 10 million people died.

Commerce:

“If you do build a great experience, customers tell each other about that. Word of mouth is very powerful.” - Jeff Bezos

Commerce is changing even rapidly than before. Previously brick and mortar stores mostly were built with standing up one store, followed by regional stores followed by going national. That led to the advent of technology and fulfillment capabilities leading way to omni-channel with e-commerce, mobile commerce and cross-channel strategies. Most were challenged by one big name Amazon by being obsessively customer centric.

We are at another inflection point where Google Shopping, TikTok and Facebook have built large commerce capabilities mostly driven by a use case other than commerce in their platforms without it being the first use case. Google built search and advertising leading to Google Shopping, Facebook built social media and ability for users across platforms such as Facebook, Whatsapp and Instagram where commerce/marketplaces are coming into the mix as an aftermath of engagement, advertisements and stories. The most latest has been TikTok that is arming itself for a looming e-commerce battle post acquiring users, who have become creators for the platform to creating viral loops for engagement that will probably soon be followed with e-commerce.

What is interesting is commerce has changed always in the way buyers and sellers interact and exchange goods and services.

Here is a snippet of Mr. Beast Burger Store opening (we will cover his story in the next episode):

Leave your comments and we will discuss this in more detail next week and why is this anymore important for commerce.

Money, Finance & Investing:

Warren Buffett once said “Only buy something that you would be perfectly happy to hold if the market shut down for 10 years”

He also said “You only have to do very few things right in your life so long as you don’t do too many things wrong”

Understanding these two concepts cannot hurt:

Ray Dalio has explained the economic machine the best:

Market Data & Flash updates that could impact Supply Chains:

Dow Jones Industrial Average: 33,606 ; Nasdaq: 11,157 ; S&P: 3,961 (At 10 AM EST) Food for thought: Nasdaq dropped by a two thousand points over the last week while the other two went up. Technology bearish is the trend with interest rates going up and cost of capital going up with growth being harder and more expensive to finance.

Annual inflation: Turkey: 85.51% Argentina: 83% Netherlands: 14.5% Russia: 13.7% Italy: 11.9% Germany: 10.4% UK: 10.1% US: 8.2% South Africa: 7.5% India: 7.41% Australia: 7.3% Brazil: 7.17% Canada: 6.9% France: 6.2% Indonesia: 5.71% S Korea: 5.7% Saudi: 3.1% Japan: 3% China: 2.8% (Source: World of Statistics)

Inflation could and will impact supply chains and its cost structures could swing both sides. Large swings is the current trend that we continue to see in a large set of commodities.

PC Shipments plunge nearly 20%, Steepest drop in more than 20 years - WSJ

Are we at the brink of the end or are we at the beginning of a new era or are we in a deep chess game? We don’t know and we will not estimate what we don’t know. We know the situation in Ukraine is grim. We know that we are at the toughest times since cold war years. We know that we are going probably have food shortages. We know that oil is probably going to become expensive.

$60 WTI Crude vs. $7,000 Bitcoin

Crypto Market & NFTs - Wild West Innovation

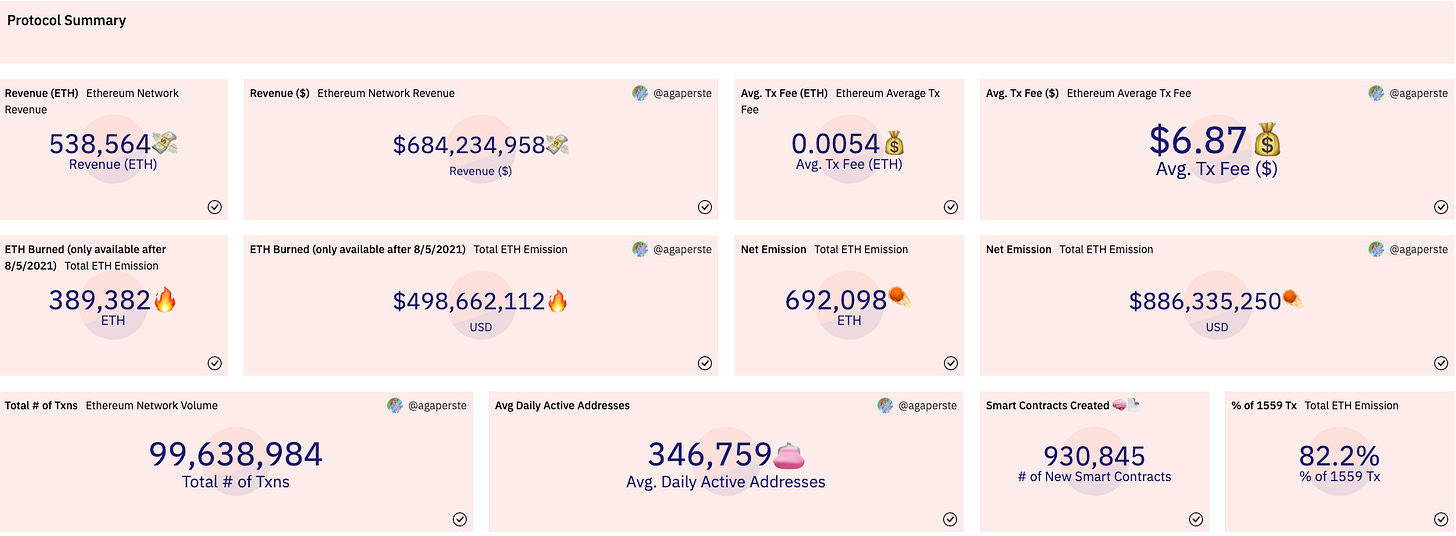

Source Ethereum Quarterly Report

This dashboard attempts to show the state of the Ethereum network for a chosen quarter. It looks at the network protocol as whole in terms of price, transactions, fees, and users. It also looks at the Ethereum ecosystem through metrics such as top projects by transaction fees and transaction volumes

Shipping: What’s happening in Bulk?

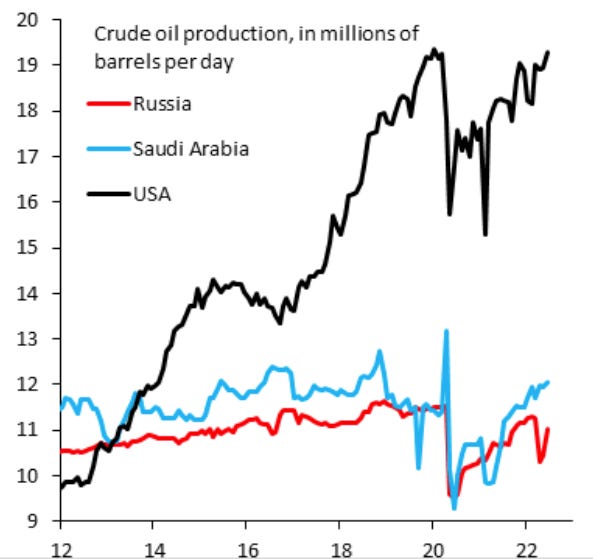

US crude oil and refined products exports surged last week to a **fresh record high**, climbing to ~11.4 million b/d. Of that, ~5 million b/d was crude. SPR Barrels are flowing overseas.

US oil production literally swamps everyone else. Food for thought: SPR Reserves apparently have reached lower than the 90’s. We don’t know how accurate the chart is but do believe there are some macro changes in the crude oil markets and OPEC, OPEC+ relationships that will influence the macro-economic conditions.

Commodities shortage and need for consumptions and reserves sends bulk shipping costs to decade high.

Interesting take on Time Charters: Dead Weight Tonnage could be gold if you were not locked in on period charters previously. Your profits are hurt and are not able to take advantage of the gold rush in the Russian Trade relevant to bulk.

Bruce Karsh of Oaktree: "The industry group that contributed the most to our losses is dry bulk shipping. I thought timing was perfect in 2012–13. Everything seemed right. Global economy was recovering. Historically depressed day rates were bottoming out, rising strongly."

Iron Ore is the bed rock of commodities world. A good thread on the current situation and where the supply is moving is usually better understood in the ships that transport them and what are they moving.

What did you get done this week?

We do a lot of things but not being laser focused creates the end or the beginning of the end. The twitter saga is so well documented and is something everyone should review and reflect on their situations.

For those who don’t know, these are the actual text message exchanges between Parag Agarwal (Ex-CEO of Twitter) and Elon Musk before the acquisition. Great guys don’t necessarily mean they are great at the problem at hand. Focus. Always Focus. Period.

What did you get done this week?

Hired a colleague after 3 years of hiatus since before Covid 19.

Bill of Lading Web Portal development in progress (First Beta launch Next Week).

First Newsletter sent through Substack.

Sagisu - Reset, Re-launch under plan.

Now it is your turn “What did you get done this week?”

What’s new at Sagisu

The Vault: We are currently live with “The Vault”. Feel free to download it. We would love to get your feedback to build the Future of Ownership.

The Vault is powered by a multi-party computation (MPC) based web 3.0 (for lack of better term) wallet that will bring ownership of assets and features that can be used cross border for Global Trade.

What’s unfolding at Sagisu

Bill of Lading

Source: BL

A Bill of Lading is a Title that keeps trading parties in clear understanding who owns the title of the goods on a ship. Bill of Lading is used by Exporters, Importers, Shippers, Shipping Agents, Customs Brokers, Freight Forwarders, NVOCC and Banks along with any other party that is involved in Global Trade.

Why should a Bill of Lading Title document travel borders as a document? Why do we need Letters of Indemnity? Why do Banks and Traders need physical documents signed by the shippers for verifying ownership? How do we solve for future of ownership?

The road to wisdom? Well, it's plain and simple to express:

Err

and err

and err again

but less

and less

and less"

- Piet Hein